Share this

What is Supplier Relationship Management (SRM)?

by Surefront on Apr 29, 2024 10:45:00 AM

Home > Blog > What is Supplier Relationship Management (SRM)?

Table of Contents

- Understanding Supplier and Vendor Management

- Building a Supplier/Vendor Management Strategy

- 5 Steps for Success

- Surefront: The Complete PLM Solution

- Further Reading

Supplier Relationship Management (SRM), Vendor Management, and Supplier Management are strategic approaches that are essential for enhancing communication and collaboration between businesses and their external suppliers or vendors. These practices are key to improving product quality, reducing supply chain costs, and driving overall business success. However, many retailers face challenges in managing these relationships efficiently, leading to chaotic workflows and missed opportunities.

In this article, we’ll explore the basics of Supplier Relationship Management (SRM) and Vendor Management, discuss the benefits of Vendor Management Software (VMS) and Product Lifecycle Management (PLM) tools, and share actionable strategies for building an effective supplier and vendor management strategy to transform your retail operations.

Understanding Supplier and Vendor Management

At its core, Supplier Management and Vendor Management involve streamlining the interaction between businesses and their external partners. These interactions cover everything from product development collaboration and procurement to performance evaluation. Effective management of these relationships ensures businesses receive the right products at the best price, on time, while maintaining product quality.

Key Components of Supplier and Vendor Management:

- Product Data and Price History: Organizing detailed records of products and financial data helps in tracking performance and making informed sourcing decisions.

- Supplier Communication: Open, transparent communication is essential for preventing misunderstandings and aligning expectations between suppliers, vendors, and retailers.

- Sustainability in Supplier Relationships: Many businesses are increasingly prioritizing sustainable sourcing practices, which must be reflected in supplier agreements and performance evaluations.

To effectively manage these relationships, retailers rely on tools like supplier scorecards, vendor performance dashboards, and procurement management software that measure key metrics such as delivery times, product quality, and contract adherence. A well-structured approach helps retailers maximize the value of their external partnerships and create a more efficient supply chain management system.

Building a Supplier and Vendor Management Strategy

An effective Supplier and Vendor Management Strategy is built around these key elements:

- Data Organization: Keeping detailed records of supplier and vendor performance, pricing data, and product specifications is vital for evaluating relationships and making strategic decisions.

- Performance Monitoring: Utilize vendor scorecards and performance evaluation tools to regularly assess supplier and vendor performance. This allows you to identify top performers and phase out under performers.

- Strategic Alignment: Ensure that your supplier contracts and performance metrics align with your broader business objectives, such as sustainability goals or cost optimization.

- Supplier Relationship Cultivation: Foster strong relationships with suppliers and vendors through regular communication and feedback. This helps drive mutual success and enhance collaboration.

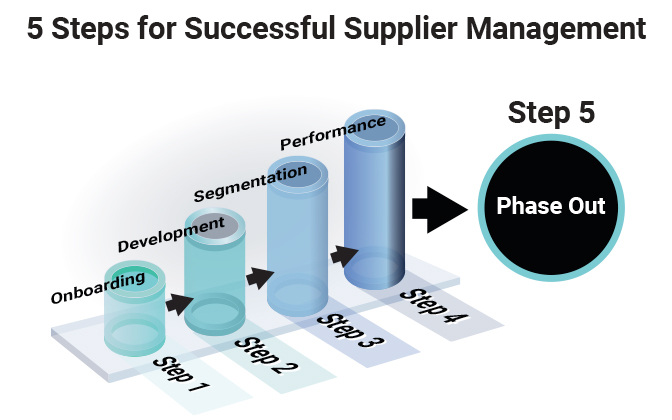

5 Steps to Implement a Successful Supplier and Vendor Management Strategy

To implement a successful supplier management strategy, focus on these five key steps:

- Onboarding: Identify and evaluate potential suppliers and vendors based on clear criteria that align with your business goals.

- Development: Use improved communication, enhanced purchasing processes, and integrated Vendor Management Software to track supplier performance and optimize the workflow.

- Supplier Segmentation: Categorize your suppliers based on performance, product type, or other factors. This helps tailor your management strategy to different supplier groups.

- Performance Evaluation: Regularly assess supplier and vendor performance using quantifiable metrics like spend, reliability, and innovation potential.

- Phasing Out: If a supplier fails to meet performance expectations or a better alternative arises, remove them from your network to maintain a high-quality supply chain.

Leveraging Vendor Management Software (VMS) and Product Lifecycle Management (PLM) Tools

Vendor Management Software (VMS) and Product Lifecycle Management (PLM) tools offer powerful solutions for managing supplier and vendor relationships. These tools help integrate product data and streamline the entire product development process, ensuring smoother communication, performance tracking, and contract management.

Key Features of Vendor Management Software (VMS):

- Centralized Vendor Data: Store all vendor information, including contracts, contact details, and performance history, in one place.

- Automated Workflows: Automate repetitive tasks like contract renewals and performance evaluations, reducing human error and saving time.

- Supplier Performance Analytics: Analyze key metrics such as delivery times, product quality, and cost efficiency to make data-driven decisions.

- Risk Management: Identify and mitigate potential risks, such as supply chain disruptions or compliance issues.

- Collaboration Tools: Built-in messaging and file-sharing tools enable real-time updates and improved communication with suppliers.

Check out our Comprehensive Guide for Product Lifecycle Management Software (PLM).

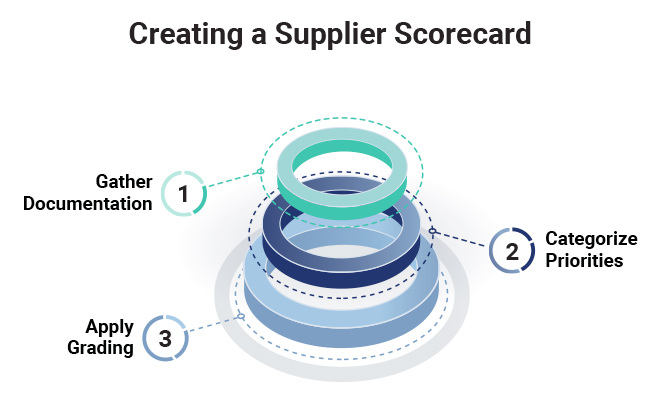

A supplier scorecard is an essential tool for evaluating supplier performance. By tracking key metrics like quality, delivery, and service, businesses can maintain high standards across their supply chain and encourage continuous improvement.

Steps to Create a Supplier Scorecard:

- Gather Documentation: Collect contracts, service level agreements (SLAs), and performance records to define expectations and benchmarks.

- Set Key Categories: Identify crucial metrics based on your business needs, such as product quality or delivery accuracy.

- Grading System: Use a simple numerical grading scale (e.g., 1-5) to measure supplier performance across these metrics.

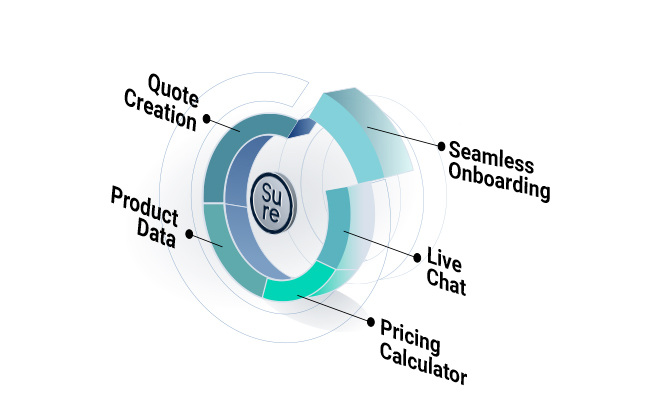

Surefront: The Complete PLM Solution for Supplier and Vendor Management

Surefront’s unified platform is designed to simplify and improve Supplier Relationship Management (SRM). Surefront integrates Vendor Management Software, Product Lifecycle Management (PLM), and Customer Relationship Management (CRM) tools, providing retailers with everything they need to manage their supply chain efficiently.

Key Features of Surefront’s Supplier Management Platform:

- Seamless Supplier Onboarding: Onboard new suppliers easily with Surefront’s centralized system, which ensures that all critical data is available and accessible.

- Enhanced Collaboration: Surefront enables real-time collaboration between suppliers and retailers, leading to improved communication and faster decision-making.

Conclusion

Effective Supplier and Vendor Management is crucial to the success of modern retail operations. By leveraging the right tools—such as Vendor Management Software (VMS) and Product Lifecycle Management (PLM) tools—and implementing a strategic approach, retailers can strengthen their relationships with suppliers, improve product quality, and enhance supply chain efficiency. Surefront’s comprehensive platform simplifies these processes, allowing businesses to stay competitive and achieve sustainable growth.

You don’t want your data to be siloed. Your company’s CRM, PIM and PLM solutions shouldn’t operate in a vacuum, either. Surefront is a unified product collaboration platform to power growth and ROI. Our patented PIM, CRM, and PLM solutions streamline the omni channel sales, merchandising and product development processes. By combining these essential functionalities, Surefront creates a single source of truth throughout your product lifecycle, sales and listing processes.

The results? Up to 150% more revenue per employee and a 40% shorter product development cycle is just the beginning. Try our 10x ROI calculator to see your company’s potential profits. Or, skip the noise and book a custom demo with one of our unified product collaboration Management experts today. The retail industry evolves quickly and has a lot of moving parts. We do all of the research, so you don’t have to. Stay ahead of market fluctuations, trends and new features by subscribing to our Unified Product Collaboration Management Blog.

Further Reading

The Complete Guide to Fashion Tech Packs

How PLM Tools Help Supplier/Retailer Relationships

Simplifying Retailer and Supplier Communication

Share this

- PLM Software (36)

- PIM Software (29)

- Apparel & Fashion (20)

- Trending Topics (20)

- Merchandising (16)

- CRM Software (13)

- PLM Implementation (11)

- Catalog Management (6)

- Tech Packs (6)

- PLM RFP (5)

- Success Stories (5)

- Sustainability (5)

- Data Import (4)

- Line Sheet (4)

- Luxury Goods & Jewelry (4)

- Product Development (4)

- Retail (4)

- Supply Chain (4)

- Category Management (3)

- Home Furnishings (3)

- Wholesale (3)

- Consumer Packaged Goods (CPG) (2)

- Cosmetics (2)

- Data Export (2)

- Health & Beauty (2)

- RFQ & Quote Management (2)

- Consumer Electronics (1)

- Import & Export (1)

- Industry Events (1)

- Inventory Management (1)

- Pet Stores (1)

- Purchase Orders (1)

- Report Builder (1)

- Textiles & Raw Materials (1)

- Unified Solution (1)

- Vendor Management (1)

- Visual First (1)

- White Paper or Case Study (1)

- workflow (1)

- October 2025 (3)

- September 2025 (3)

- August 2025 (4)

- April 2025 (4)

- March 2025 (3)

- January 2025 (8)

- December 2024 (5)

- November 2024 (3)

- October 2024 (5)

- September 2024 (6)

- August 2024 (2)

- July 2024 (1)

- June 2024 (3)

- May 2024 (4)

- April 2024 (5)

- March 2024 (3)

- February 2024 (2)

- December 2023 (4)

- September 2023 (2)

- August 2023 (5)

- July 2023 (3)

- June 2023 (2)

- May 2023 (2)

- April 2023 (4)

- March 2023 (5)

- February 2023 (3)

- January 2023 (5)

- December 2022 (4)

- November 2022 (3)

- October 2022 (4)

- September 2022 (5)

- August 2022 (4)

- July 2022 (2)

- May 2022 (1)

- February 2022 (1)

- January 2022 (1)

- September 2021 (1)

- May 2021 (1)

- April 2021 (1)

- February 2021 (1)

- May 2020 (1)